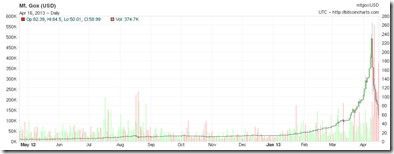

In April, 2013 I successfully predicted a severe correction in Bitcoins based on bubble principles. 7 months later, Bitcoin is at all-time highs once again. According to Elliot Wave Principle, market movements following the overall trend of that market occur in 5 waves: 3 impulsive waves with the trend and 2 corrective waves against the trend. Once the 5-waves are complete, a prolonged corrective period occurs where prices reverse the overall trend.

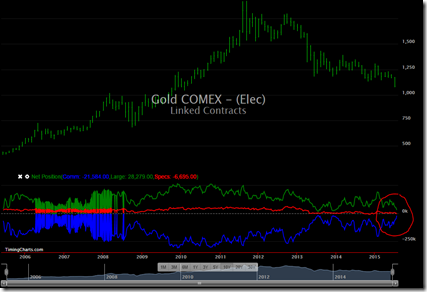

Take a look at the charts below (note that each successive chart is a magnification of the previous chart, as identified by the red dashed box in each larger chart). The first chart below shows lifetime price action. Note that prices have clearly moved in 5-waves. Interestingly, each wave formed it’s own mini-bubble:

- The first wave ended in June, 2011, at $30. It was parabolic in nature, and corrected all the way down to $2 by Dec, 2012.

- The third wave ended in April, 2013 at 266. Once again, it was parabolic in nature, and suffered an extremely sharp 80% decline in a few days. Then, prices moved sideways for a few months to finish correcting the excess.

- Finally, the 5th wave is following the typical parabolic pattern. Buyers who entered the market near the end of Wave3 (in the $50-200 range) are all making a huge profit (5-10x). However, since we are nearing the end of the cycle, an imminent, long-term correction is about to begin. This will be a painful downtrend characterized by daily decrease in prices, with the occasional brief rally.

The second chart below shows 6 months starting around the Wave 4 low from the chart above. Note that the wave principle is fractal in nature, and Wave 5 of the larger trend breaks down into 5 subwaves (i thru v).

Finally, looking at the 10-day chart starting around the Wave iv low from the chart above, we see 5-waves unfolding once again. Drilling down through each successive chart indicates that at each time frame, we are in the 5th wave of the rally.

From the purely technical perspective of Elliot Wave analysis, the charts are showing a marked exhaustion of the 5-wave trend. While there is potentially a bit more upside left, I would predict that the trend is weeks, if not days away from expiring.

One other interesting point is the “personality” of the 5th wave. Elliot Waves have distinct characteristics since they reflect the mentality of the herd. In wave 5, “…The news is almost universally positive and everyone is bullish. Unfortunately, this is when many average investors finally buy in, right before the top.” (Hint, hint, family and friends finally “seeing the light”). Furthermore, “Volume is often lower in wave five than in wave three” as you can see from the first chart. Finally, “…At the end of a major bull market, bears may very well be ridiculed…” as evidenced by yours truly.

Bitcoins may be a very useful medium of exchange and they may prove to be successful long term. But in the medium term, a market will always work in the same way: It will never go up forever, and it will always make sure to minimize real gains for investors by natural price corrections. Therefore, if you’re holding on to a nice profit in Bitcoins, it may be a wise time to sell the majority. You will have a chance to buy back at much reduced prices in the coming months.